One of the main risks retirees face is outliving their retirement savings. Many of us will live for 30 years beyond retirement age, so we expect our retirement savings to ‘work’ for as long as we have worked. The ideal time to start saving for your retirement is with your first pay cheque. A good rule of thumb to allow you to maintain your lifestyle later on is to save 17% of your salary starting at age 25. If you start later, you will naturally need to save more or consider retiring later.

Why Invest in a Retirement Annuity?

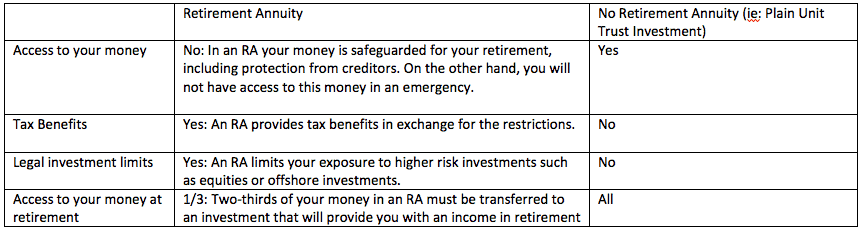

– You get Tax Benefits: Your contributions to an RA are tax deductible and the returns you earn while invested are tax free.

– You only need R500 a month: You decide how much to invest – at least R500 a month or a single lump sum of R 20 000 if you don’t want to make a monthly investment. You can make changes whenever you need to, no transaction fees and no penalties (with certain providers).

– Your investment is safeguarded… even from you: The restrictions in an RA aim to ensure your money is kept for retirement and that it is protected from potential creditors.

Your RA investment continues until you decide to take your money out after the age of 55 to use it for a regular income. You must put at least two-thirds of your RA into another investment that will provide you with an income. At retirement, you can take up to one-third as a cash lump sum if you need to. You can withdraw your full investment if you have less than R7000, or if you emigrate. If you become permanently disabled, you can request early retirement.

How does investing via a retirement annuity compare to investing in unit trusts without one?

Your RA does not form part of the value of your estate, which means that your money will not attract estate duty. A board of trustees is responsible for running the RA and protecting the interests of all members. If you die while you are still invested in your RA, in terms of legislation, the trustees must thoroughly investigate your dependents and/or beneficiaries and allocate your money according to need. This process can take up to a year.

—